Android

Scan to download

Scan this code to download on your mobile device.

Open Account

EARN AND GROW

AS A TRADER

Invest with confidence whenever and wherever you want.

Trading Tools

Explore some of the bonuses you'll get to enjoy when you trade with us.

We are pleased to introduce an innovative addition to our trading services: CopyTrading. Recognizing the intricacies and time constraints often associated with financial markets, we have devised a solution that simplifies your trading experience. With CopyTrading, you have the opportunity to emulate the strategies of accomplished traders who have demonstrated consistent success.

How does copy trading work?

Copy trading is a program where a customer (copier) can link it's MT4 account to the strategy of a provider registered in the platform.

Is copy trading risky?

As every trading tool, copy trading has its risks, associating your account as a copier to the strategy of the provider.

How can I find traders to copy?

Registering as a copier in the platform https://copytrading.traze.com/portal/login?redirectUrl=%2F and check the providers registered.

How do I connect the copy trading app to my MT4 account?

Registering in the platform https://copytrading.traze.com/portal/login?redirectUrl=%2F automatically the system will connect the MT4 with the copy trading app.

What is the minimum amount I need to copy trade?

As a follower, the minimum amount required is 100 USD.

Am I able to change the size of a trade I'm copying?

Not by now, since vendor has other customizations.

Can I copy multiple traders at the same time?

No, you can follow one provider at once.

Introducing CopyTrading at TRAZE

CopyTrading

Coming Soon

Sign up and get your

basic trading course -

Absolutely free!

basic trading course -

Absolutely free!

Please fill up the form below.

Building a successful strategy in the context of forex trading is a multifaceted endeavor that demands careful planning and continuous refinement. First and foremost, traders must begin by setting clear objectives and risk tolerance levels. These objectives could include profit targets, risk management rules, and the duration of trades. Assessing one's risk tolerance is critical, as it helps in determining the appropriate position size and leverage to use in each trade. A conservative risk management approach can protect traders from catastrophic losses and ensure that they can continue trading even after a series of losing trades.

Next, a comprehensive market analysis is essential for building a forex trading strategy. Traders must stay informed about economic indicators, geopolitical events, and technical factors that can influence currency prices. Fundamental and technical analysis tools can be used to identify potential entry and exit points. Additionally, traders should consider using a combination of technical indicators, such as moving averages, RSI, and Fibonacci retracements, to validate their trading signals. It's important to remember that there is no one-size-fits-all strategy in forex, as different trading styles (day trading, swing trading, or position trading) require distinct approaches.

Consistent backtesting and continuous learning are crucial aspects of refining and adapting a forex trading strategy over time, as market conditions can change rapidly. Ultimately, a well-thought-out strategy combined with discipline and patience can increase the likelihood of success in the challenging and dynamic world of forex trading.

Consistent backtesting and continuous learning are crucial aspects of refining and adapting a forex trading strategy over time, as market conditions can change rapidly. Ultimately, a well-thought-out strategy combined with discipline and patience can increase the likelihood of success in the challenging and dynamic world of forex trading.

Introducing Building a strategy at TRAZE

Building a Strategy

Coming Soon

Building a successful strategy in the context of forex trading is a multifaceted endeavor that demands careful planning and continuous refinement. First and foremost, traders must begin by setting clear objectives and risk tolerance levels. These objectives could include profit targets, risk We're thrilled to introduce an exciting new feature that will soon be available to our valued clients – Trading Signals!

We understand the importance of informed trading decisions, and our Trading Signals will empower you like never before. With this feature, you'll receive real-time, expert-generated signals directly to your trading platform, helping you identify potential market opportunities with ease. Whether you're a seasoned trader or just starting your forex journey, these signals will provide invaluable insights, enhancing your trading strategies and boosting your chances of success.

Stay tuned for the official launch, as we continue to innovate and deliver the tools you need to thrive in the forex market. Your success is our priority, and Trading Signals are just one more way we're committed to helping you achieve your financial goals.management rules, and the duration of trades. Assessing one's risk tolerance is critical, as it helps in determining the appropriate position size and leverage to use in each trade. A conservative risk management approach can protect traders from catastrophic losses and ensure that they can continue trading even after a series of losing trades.

Stay tuned for the official launch, as we continue to innovate and deliver the tools you need to thrive in the forex market. Your success is our priority, and Trading Signals are just one more way we're committed to helping you achieve your financial goals.management rules, and the duration of trades. Assessing one's risk tolerance is critical, as it helps in determining the appropriate position size and leverage to use in each trade. A conservative risk management approach can protect traders from catastrophic losses and ensure that they can continue trading even after a series of losing trades.

Introducing Trading Signals at TRAZE

Trading Signals

Coming Soon

Are you interested

in one of those services?

in one of those services?

Could you please replace this sub header, with something that relate to this section, thanks!

Open Account

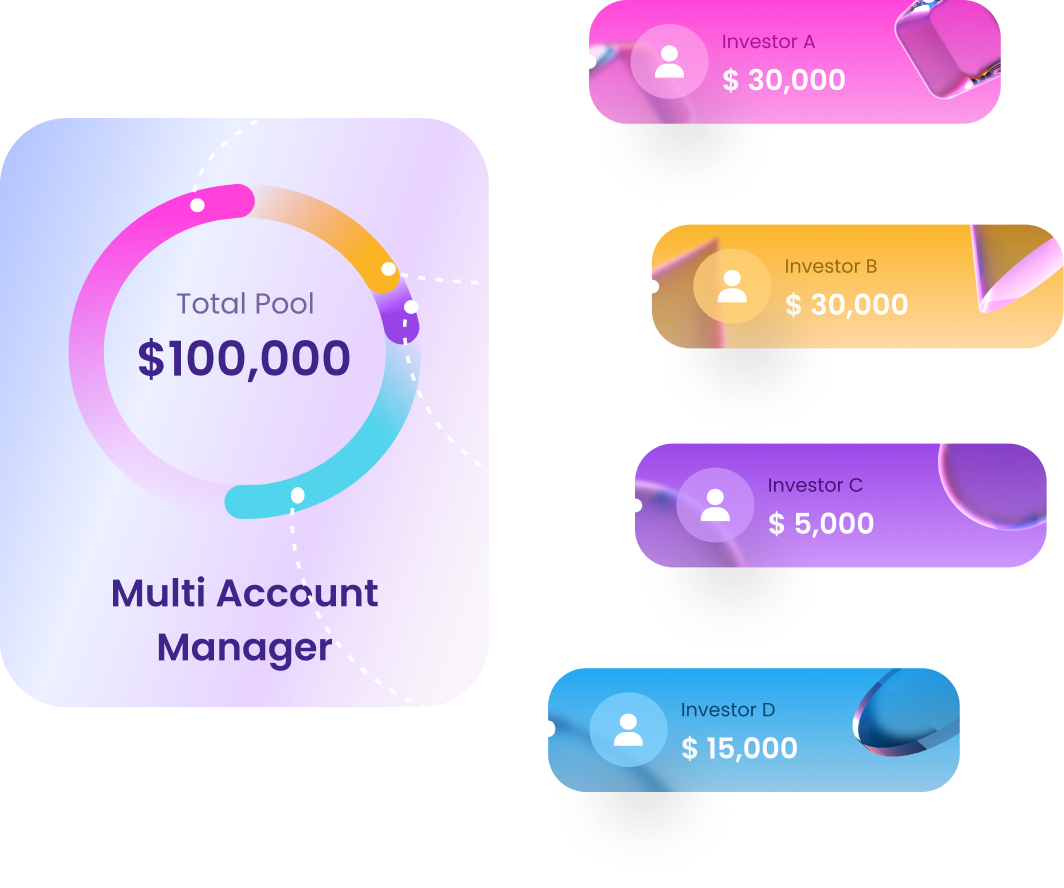

MAM Account

The Multi Account Manager (MAM) is suitable for Money Managers, Hedge Funds, and Family Offices. With Traze’s MAM account, investors can sign a Limited Power of Attorney with their manager of choice, agree on a performance fee, and Traze will act as custodian ensuring the manager receives the agreed-upon percentage all while the investor has full control of her/his account. Traze’s MAM account accommodates performance, management, and trade fees.

Client Allocations starting from as little as 0.01 lots

Utilize all MT4 order types stops, limits, trailing stops, close all etc.

Real Time Control of Positions and P&L Monitoring of Managed Accounts.

Sign up now

and get started

and get started

Please fill up the form

MAM Account

Coming Soon

Interest Program

Coming Soon

Cash Back

Coming Soon

Are you ready

to start right now!

to start right now!

Open Account

Earn Money With Us

Bonus Incentive

How to earn money with us

Endless opportunities to earn and grow

Zeal Group is a financial institution specializing in providing multi-asset trading services including currencies (foreign exchange, forex or FX), commodities, indices, shares and cryptocurrencies to institutional and retail investors, and is mainly compensated for its broking services through bid/ask price differences (spread) and/or commissions.

Official Website: www.traze.com

Traze is trading name of Zeal Group,

and may be used exclusively by its affiliated entities with permission.

© 2022 Traze

Official Website: www.traze.com

Traze is trading name of Zeal Group,

and may be used exclusively by its affiliated entities with permission.

© 2022 Traze

Risk Warning: Contracts for Difference (CFDs) are complex instruments and come with a high risk of losing money rapidly due to leverage. You may be required to make further deposits in order to meet your margin requirements. You should consider whether you understand how CFDs work and whether you can afford to take the risk. The historical financial performance of any underlying instrument is no guarantee or indicator of future performance. Trading financial derivatives may not be suitable for all investors. Please ensure that you fully understand the risks involved, and seek independent advice if necessary.

TRAZE is a trade name of Zeal Capital Market (Seychelles) Limited, which is regulated as a Securities Dealer by the Financial Services Authority of Seychelles, license number: SD027. Its principal office is at: Office 1, Unit 3, 1st Floor, Dekk Complex, Plaisance, Mahe, Seychelles.